.png?token=6d03145852b99b5eb23e4e176576bc1b)

DWG 1st Quarter 2020 Market Update

On February 19th, 2020 the S&P 500 was making another all-time intraday high hitting 3,393.52. Fundamentals remained strong as we set up for another good quarter in the markets. This was to be followed by the fastest bear market in history. A bear market is typically defined as a fall of 20% from a previous high mark. The current bear market reached 20% in only 21 trading days. The second fastest was in 1929 and took 36 sessions.

Exhibit 1: Index Decline From Peak

.png?token=0ac458da97d8eab2275a5f1a7e8ea6fa)

Stocks proceeded to fall for another seven trading sessions. On March 23, a three-day bull rally ensued. When all was said and done, the S&P 500 had rebounded an astounding 17.6%. Other stock indexes rose in similar fashion. The rally was a welcome end to a highly volatile quarter which closed with the S&P 500 down 20% and the Dow down 23.3%.

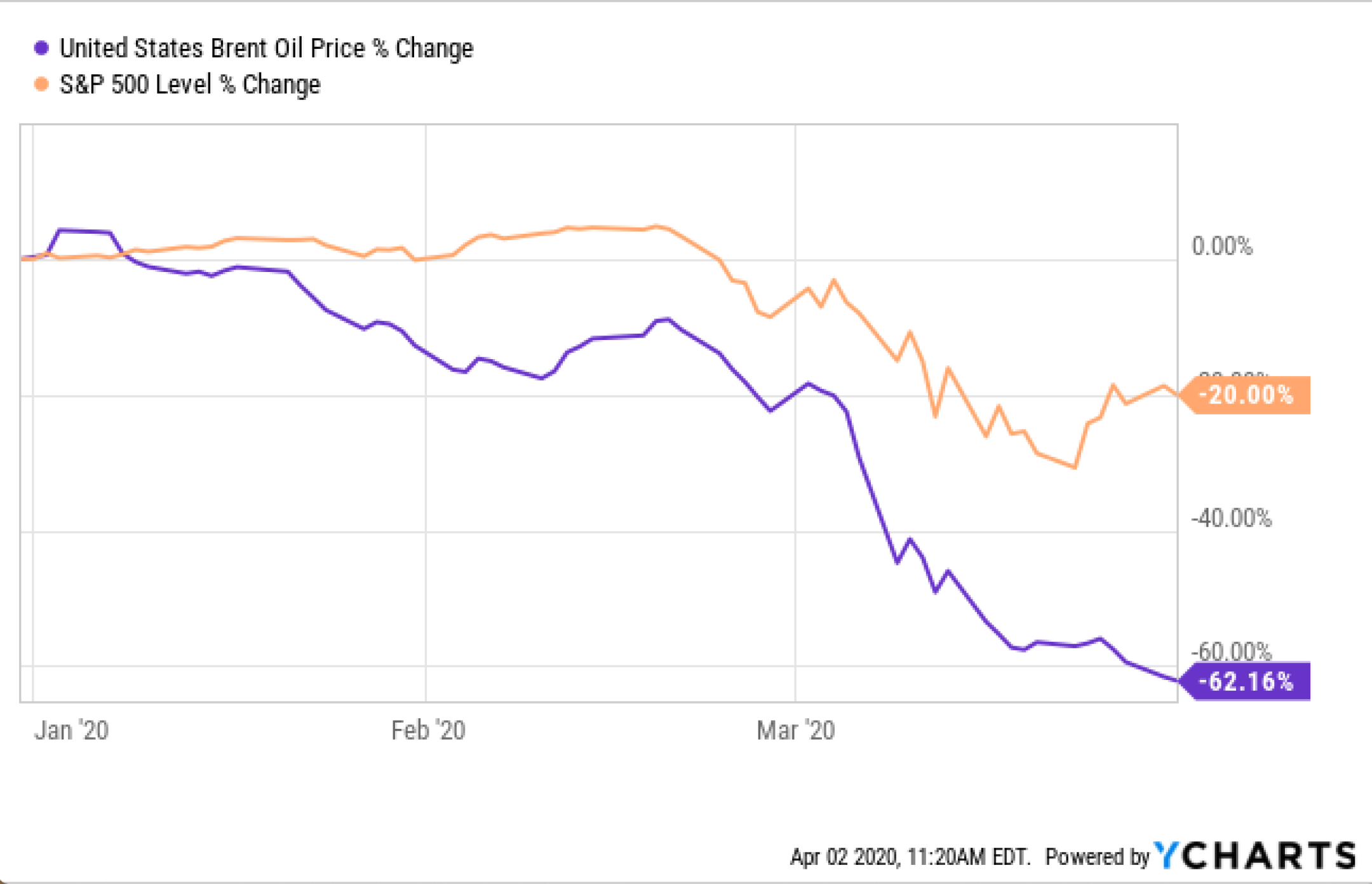

The COVID-19 virus spread and the potential impact on the global economy set in motion the aforementioned stock market drops. However, amidst everyone rushing to buy toilet paper, an oil war broke out between Saudi Arabia and Russia. Oil exploration and extraction, refiners, and oil servicing companies tumbled in dramatic fashion as the price of a barrel of Brent Crude sank 50% and provided an additional catalyst for the equity markets to fall as seen in Exhibit 2.

Exhibit 2. Change in Oil vs. S&P 500

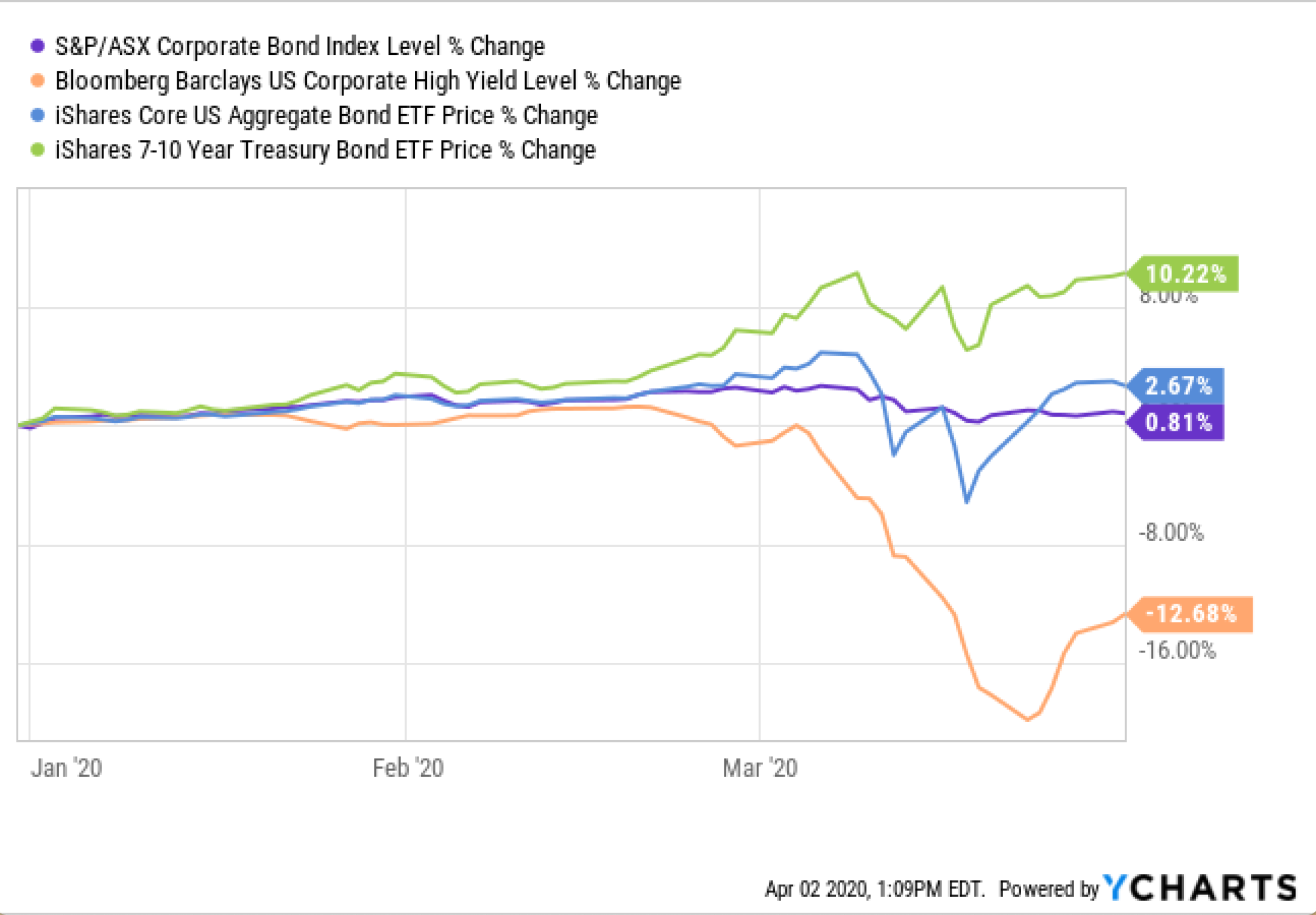

Stock market and economic uncertainty coupled with Fed buying was a boon for high quality fixed income. Treasury yields dropped to record lows during the quarter with the three-month bill dipping into negative territory and the ten-year dropping as low as 0.31%. The flight to quality in bonds was felt in the corporate bond sector as well, as corporate bonds stayed positive for the quarter. However, high yield bonds were sold off as investors fled the risky asset. The high yield sell-off was exacerbated by the plunge in oil as 10% of outstanding high yield debt was issued by companies directly tied to the oil market.

Exhibit 3. Fixed Income Markets

The second quarter should provide valuable insight into the economic fallout caused by the COVID-19 pandemic. Consensus opinion says we’re at the beginning of a recession which could last well into 2020 or early 2021. The duration of the recession will in part be determined by the total response of the government and our fellow citizens. We should have a better idea in the coming months.

We have received three phases of the government plan for reinvigorating the economy, alleviating unemployment hardship, and bridging business gaps. With much of the world in some form of “stay-at-home” order for the near term, there is speculation a fourth round of stimulus will be needed to spur the economy and lift it out of the looming recession.

We believe, once the COVID-19 initial threat is behind us, there will be pent up demand and a desire to return to “normal life.” However, unemployment must work itself out before people feel comfortable spending again.

Before the year started, we were carrying extra cash in our portfolios due to the uncertain political climate, the extended bull market, and long term market uncertainties. We were well positioned with investments for the recession and will be even better positioned to take advantage of the market recovery when it starts. On average our portfolios only experienced half or less of the market downturn. Our commitment is to remain vigilant as we evaluate the data available to us and proceed to put capital to work.

Know we are here for you.

Stay safe!

The Darden Wealth Team

.png?token=c1f2c94e49a33c7a2f6557d4ba89f6d9)