.png?token=de9159494b00b98db84248052395c9a5)

DWG 3rd Quarter 2020 Market Update

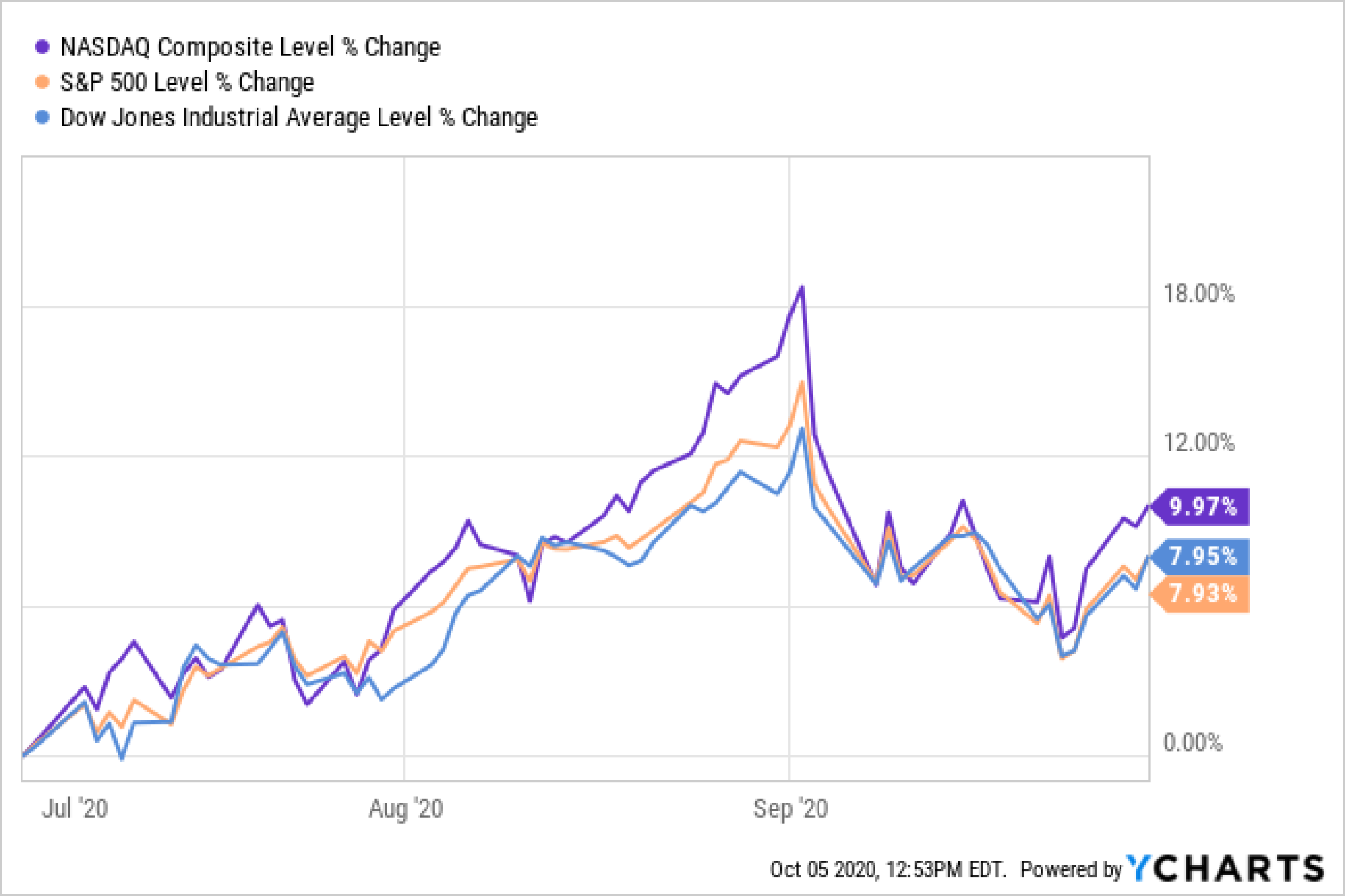

The third quarter of 2020 got off to a roaring start with the bulls retaining dominance in the market. The S&P 500 and Nasdaq tallied multiple record highs while posting the best August return since 1986. There are a number of possible explanations for the early quarter euphoria:

- Stronger than expected corporate earnings announcements

- Progress on a Covid-19 vaccine

- Potential for additional stimulus

- Reduction in unemployment

Exhibit 1.

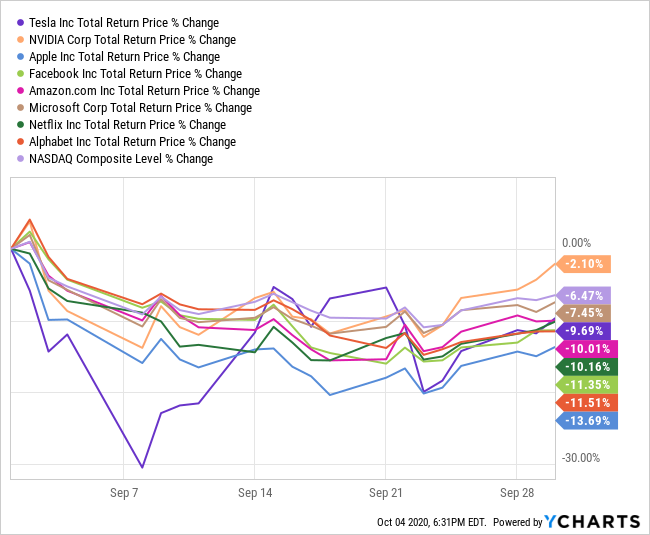

Following a strong September start, bears grabbed hold and dragged the indexes lower over the remainder of the month. The Nasdaq reached correction territory off the August peak thanks in part to the sell off in big tech and Tesla, which at one point was lower by more than 30% from the beginning of the month.

Exhibit 2.

In our view, the September pull back was precipitated by:

- Lofty valuations within technology

- Lack of a stimulus deal

- Election uncertainty

- Increasing Covid-19 cases

- Increased analyst estimates for Q3 earnings

In addition to the aforementioned factors, September has historically been the worst performing month for the stock market averaging a return of -.70% from 1980 to 2019.

Our portfolios remain overweight in cash and high quality fixed income. We expect volatility to remain elevated going into the election. Several questions surrounding the election, a Covid-19 vaccine, monetary stimulus, corporate earnings, and the direction of the economy will all add to the uncertainty but clarity will come as the quarter progresses.

.png?token=c1f2c94e49a33c7a2f6557d4ba89f6d9)